We Buy Houses in St. Louis Missouri: Top Situations to Use a Direct Sale

We Buy Houses in St. Louis Missouri: Top Situations to Use a Direct Sale

Blog Article

The Ultimate Overview to Deal Residence With Confidence and Relieve

Guiding via the property market can be daunting for both vendors and purchasers - we buy houses in st louis. Recognizing market trends and preparing finances are essential actions. In addition, selecting the right realty representative can greatly influence the purchase's success. With various strategies readily available, knowing exactly how to come close to buying or selling a home is important. The adhering to areas will certainly unpack these elements, assisting individuals towards educated and certain decisions in their real estate journey

Recognizing the Property Market

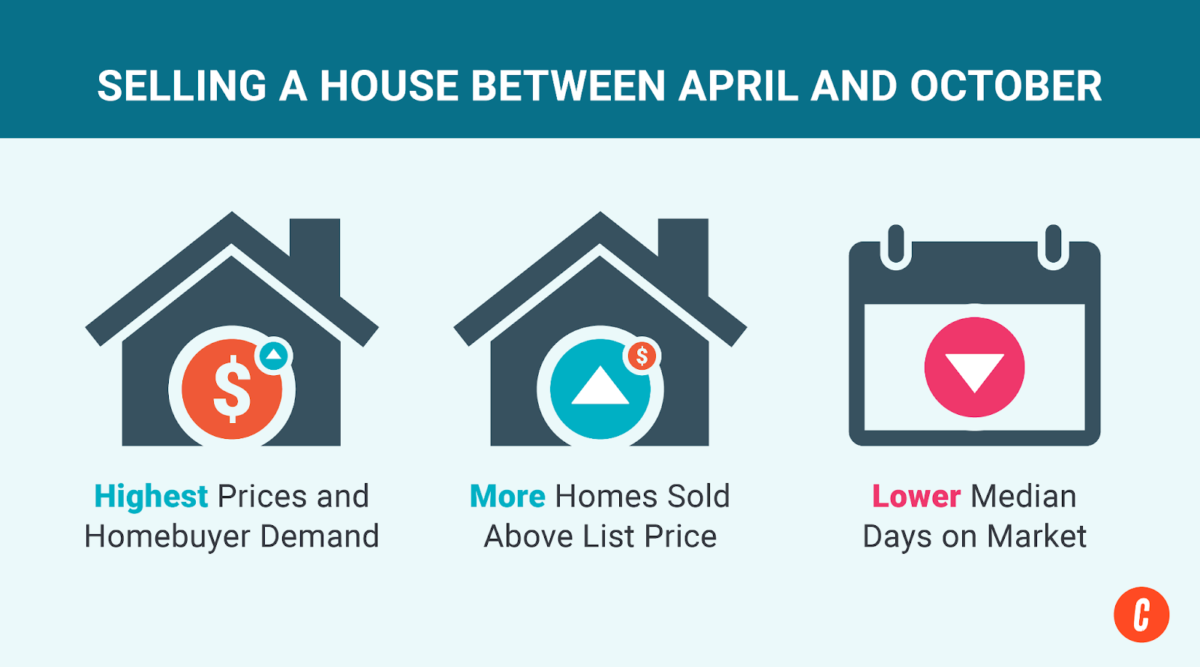

Comprehending the genuine estate market is essential for any person aiming to purchase or market a home, as it provides insights right into prices trends and need variations. Market characteristics, consisting of neighborhood financial problems, rate of interest, and seasonal variations, play an essential duty fit buyer and vendor habits. Customers benefit from acknowledging when to enter the market, as rates may vary based on supply and demand. Vendors, on the other hand, need to understand how their residential or commercial property's worth is affected by similar listings and current sales in the location. Informed decisions come from examining these aspects, enabling both events to browse arrangements effectively. Eventually, a comprehensive understanding of the property landscape equips individuals to achieve their housing goals confidently.

Preparing Your Financial resources

Preparing financial resources is a critical step in the home acquiring process. It includes evaluating one's budget plan, comprehending different funding choices, and checking the credit history. These components are essential for making educated choices and making sure a smooth purchase.

Analyze Your Spending plan

Assessing a spending plan is a vital action in the home getting procedure. Property buyers must first determine their financial capacities to stay clear of exhausting themselves. This includes analyzing income, financial savings, and present costs to develop a reasonable rate array for prospective homes. It is crucial to represent extra prices such as property tax obligations, upkeep, closing, and insurance policy costs, which can considerably affect total price. By creating a comprehensive spending plan, purchasers can identify what they can comfortably spend without sacrificing their monetary security. In addition, this assessment helps buyers prioritize their demands and wants in a home, guaranteeing they make informed decisions throughout the buying journey. Inevitably, a tactical budget plan lays the groundwork for an effective home getting experience.

Understand Funding Options

Browsing through the myriad of financing options available is crucial for homebuyers wanting to safeguard the most effective bargain for their new residential property. Purchasers need to familiarize themselves with numerous kinds of home loans, such as fixed-rate, adjustable-rate, and government-backed financings, each offering distinct benefits and eligibility criteria. Comprehending deposit requirements, rates of interest, and loan terms can significantly influence overall cost - cash home buyers in St. Louis MO. Furthermore, checking out choices like FHA lendings, VA finances, and USDA car loans can provide beneficial terms for particular buyers. It's additionally essential for homebuyers to assess alternate funding approaches, such as exclusive fundings or seller financing, which may provide distinct chances. Ultimately, notified decision-making pertaining to funding can result in a smoother acquiring experience and better economic security

Check Credit Report

Exactly how well do property buyers comprehend the value of inspecting their credit history before diving into the home purchasing process? Lots of prospective purchasers ignore its importance, yet a credit history score acts as a crucial sign of financial health and wellness. Lenders use this score to review the danger of prolonging credit report, affecting both loan approval and rate of interest. A greater rating can cause better financing choices, while a reduced score might lead to higher loaning prices or perhaps rejection of finances. It is vital for property buyers to examine their credit report records for accuracy, dispute any mistakes, and take steps to boost their ratings if required. By doing so, they enhance their possibilities of protecting beneficial home mortgage terms, leading the method for a successful acquisition.

Finding the Right Property Representative

Discovering the best property agent can greatly affect the success of a home purchasing or offering experience. A knowledgeable agent comprehends neighborhood market patterns, pricing approaches, and settlement techniques. Possible customers and sellers should seek referrals from close friends or household and check out online reviews to determine a representative's reputation. It is essential to interview several agents to assess their knowledge, communication design, and compatibility with individual goals. Additionally, confirming qualifications and inspecting for any kind of disciplinary actions can supply understanding right into expertise. Inevitably, choosing an agent that shows a solid dedication to client fulfillment can cause a smoother transaction process and an extra desirable end result. An appropriate agent functions as a beneficial ally throughout the realty trip.

Tips for Home Purchasers

When acquiring a home, purchasers need to focus on investigating neighborhood trends to recognize market characteristics and property worths. Additionally, securing financing choices is vital to guarantee that they can manage their wanted home without monetary pressure. These fundamental actions can greatly affect the total buying experience and future financial investment success.

Research Study Community Trends

Understanding community trends is essential for home customers looking for to make informed choices. By studying neighborhood market dynamics, purchasers can recognize locations with possibility for admiration or decline. Trick variables to take into consideration consist of recent list prices, the average time homes spend on the marketplace, and the general sales quantity. On top of that, reviewing demographic changes, institution ratings, and features can provide understandings into community worth. Customers need to likewise understand future developments, such as infrastructure projects or zoning modifications, that could affect building values. Involving with local homeowners and realty experts can use added point of views. Eventually, extensive research right into area patterns equips customers to choose locations that line up with their way of life and investment objectives.

Secure Financing Options

Safeguarding funding alternatives is an essential action for home buyers, as it straight influences their buying power and total budget. Buyers should explore numerous financing avenues, such as standard lendings, FHA fundings, and VA fundings, each offering distinct advantages. A thorough understanding of rate of interest and finance terms is important to make enlightened choices. Furthermore, safeguarding pre-approval from lenders can provide an one-upmanship in arrangements, showing economic preparedness to sellers. Home customers ought to consider their long-lasting financial objectives and choose a mortgage that aligns with their plans. It's a good idea to compare multiple loan providers to find the finest rates and terms. Inevitably, a well-researched funding approach can equip buyers to browse the housing market with self-confidence.

Strategies for Home Sellers

Efficient strategies for home vendors are necessary for accomplishing a successful sale in a competitive realty market. Initially, valuing the home precisely is important; conducting a relative market evaluation assists establish a competitive price. Next, boosting visual charm via landscaping and small fixings can bring in potential customers. Furthermore, organizing the home to display its ideal attributes allows buyers to picture themselves living in the room. Expert photography is also crucial, as top notch images can greatly increase rate of interest online. Ultimately, leveraging on-line advertising systems Clicking Here and social networks can broaden the reach, drawing in more potential purchasers. By carrying out these techniques, home sellers can improve their opportunities of a lucrative and fast sale.

Navigating the Closing Process

As buyers and vendors come close to the lasts of a realty deal, steering with the closing process comes to be an important step towards possession transfer. This stage typically includes a number of essential components, including the conclusion of documents, the last walkthrough, and the transfer of funds. Purchasers ought to conduct an extensive evaluation of the closing disclosure, guaranteeing all terms align with the acquisition contract. On the other hand, sellers must plan for the transfer of tricks and any agreed-upon repair services. Involving a certified property attorney or agent can simplify this procedure, ensuring see page compliance with neighborhood laws and dealing with any kind of last-minute issues. Inevitably, clear communication in between all parties is critical to assist in a smooth closing experience and secure the effective transfer of property ownership.

Post-Sale Considerations

After the sale is wrapped up, buyers and sellers must frequently navigate a range of post-sale considerations that can considerably affect their experience - we buy houses in st louis. For customers, relocating right into a brand-new home entails upgrading insurance coverage, moving utilities, and dealing with any kind of needed fixings. They must also acquaint themselves with regional laws and community dynamics. Sellers, on the various other hand, might require to take care of economic effects such as funding gains tax obligations and ensure that any staying commitments connected to the residential or commercial property are met. Both events ought to keep open lines of interaction for prospective disputes and make sure that all documents are appropriately stored for future referral. By attending to these factors to consider promptly, both customers and vendors can delight in a smoother change right into their new situations

Regularly Asked Questions

How Do I Choose Between Offering My Residence or Leasing It Out?

Choosing between selling or renting out a home includes evaluating economic objectives, market conditions, and personal scenarios. One need to take into consideration prospective rental earnings, home management responsibilities, and future housing demands before making a decision.

What Are the Tax Ramifications of Offering a House?

When taking into consideration the tax implications of selling a residence, the private should represent resources gains tax obligation, prospective exemptions, and any type of reductions associated with selling expenditures, which can significantly affect the last economic result.

Exactly How Can I Identify My Home's Market Value?

To identify a home's market price, one need to consider recent sales of comparable residential or commercial properties, consult a realty representative, and evaluate regional market patterns, ensuring a comprehensive understanding of the building's worth in existing conditions.

What Should I Disclose to Prospective Customers?

When offering a home, it is important to divulge any recognized problems, past fixings, and legal problems. Openness cultivates trust fund and can protect against future disputes, inevitably benefiting both the seller and prospective buyers during settlements.

Just How Can I Manage Numerous Deals on My Home?

Handling helpful hints several offers on a home needs clear communication with all prospective customers. Assessing deals based on terms, contingencies, and monetary stamina can aid sellers make notified choices, inevitably resulting in the most effective end result. In addition, this assessment assists purchasers prioritize their requirements and wants in a home, ensuring they make notified choices throughout the purchasing journey. When buying a home, purchasers ought to prioritize looking into area trends to understand market dynamics and building values. Understanding neighborhood patterns is necessary for home purchasers seeking to make informed decisions. Securing financing options is a crucial action for home customers, as it directly influences their buying power and total spending plan. Home customers must consider their long-lasting financial goals and pick a home mortgage that aligns with their strategies.

Report this page